Not sure whether to buy now or stay put?

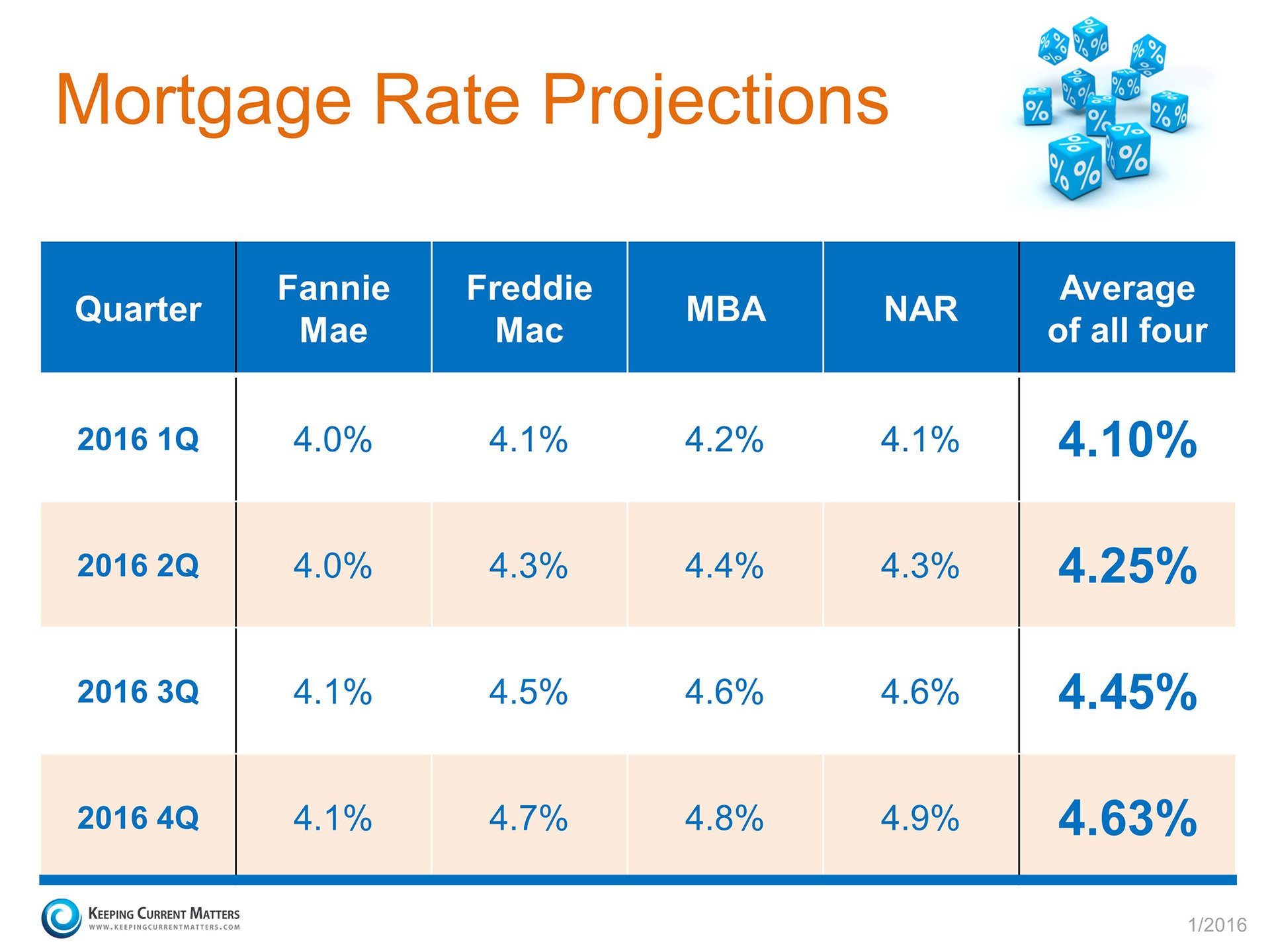

Experts agree mortgage interest rates are predicted to rise by an average of three quarters of a percentage point. This could cost an average homeowner $133/month on a $300,000 mortgage. Looking at it another way today's 4% rates gets you a $300,000 mortgage for $1432/month. If the rates change to 4.75% the same monthly payment only gets you a $274,500 mortgage. You can lose $25,500 in buying power for the same money.

Some current homeowners trying to time the market to sell could actually hurt themselves in the long run, especially move-up buyers. You'll likely make a little more money on your current home then end up paying more on the new one. Double that with higher interest rates waiting to upgrades looks like a lose-lose. Now is the time to make your move!

Some current homeowners trying to time the market to sell could actually hurt themselves in the long run, especially move-up buyers. You'll likely make a little more money on your current home then end up paying more on the new one. Double that with higher interest rates waiting to upgrades looks like a lose-lose. Now is the time to make your move!

First time buyers who are saving for a down payment could consider using smaller down payment programs. Our lending partner Mortgage Express has many different loan programs as low as zero down payment. Call me 214-552-2091, I would be happy to discuss many options available with small or no down payment.

Bottom Line

Even a small increase in interest rates can put a dent in your family’s wealth.Find out now What Your Home is Really Worth!

www.RaymondEdler.com

214-552-2091

No comments:

Post a Comment